Visits: 12

Robert De Niro, Al Pacino and Ray Romano star in Martin Scorsese’s “The Irishman.”

Netflix

Netflix is never going to adhere to the traditional rules of the box office.

Yes, the streaming service creates its own content, but it isn’t a Hollywood movie studio. Ninety-day film releases at 3,000 theaters across the U.S. just aren’t what Netflix does. And that’s not about to change, even with a big name like Martin Scorsese.

Scorsese’s most recent film, a gangster pseudo-biopic called “The Irishman,” is currently getting a limited run in theaters in New York and Los Angeles. It will roll out to a few more cities over the next few weeks before finally arriving on Netflix on Nov. 27.

Demand for tickets has been high, as Scorsese fans clamor to see his most recent work, which has already been widely praised by critics as “a new American classic.” Tickets for showings at the Belasco Theater in New York are currently on StubHub for between $65 and $85 each.

The three-hour-and-30-minute flick was passed over by several studios before being nabbed by Netflix. The $100 million production budget, reliance on digital de-aging technology and run-time length were all concerns. Especially, considering the fact that in the last few years it has become harder and harder for movies that aren’t blockbuster tentpoles, franchise-linked or animated to post a profit.

“The Irishman” is about prestige. Snagging Scorsese’s latest picture will drive incremental sign-ups to its platform for those who are unable to see the Robert De Niro, Al Pacino and Joe Pesci-led gangster film.

The only reasons “The Irishman” is playing in theaters before it is released on Netflix is because Scorsese, who has recently lamented that big blockbuster Marvel films aren’t “cinema,” asked for it to be and because Netflix wants the film to be eligible for Oscar contention.

The Academy of Motion Picture Arts and Sciences’ eligibility requirements state that a film must run at least seven consecutive days at a commercial theater in Los Angeles County and be shown at least three times a day, with at least one screening between the hours of 6 p.m. and 10 p.m.

It’s the same strategy that Netflix employed with the Oscar-winning “Roma.”

What if…

However, in distancing itself from wide releases and longer runs at major cinema chains, Netflix could be leaving quite a bit of money on the table.

“You are talking about millions of dollars,” Paul Dergarabedian, senior media analyst at Comscore said. “People line up to see a Scorsese movie. But, again, that’s not the model they are chasing.”

Of course, traditional studios passed on “The Irishman” two years ago, believing it wouldn’t be able to make back its production or marketing budget.

“[‘The Irishman’] certainly could make $100 million,” Doug Stone, president of Box Office Analyst and a theater owner, said.

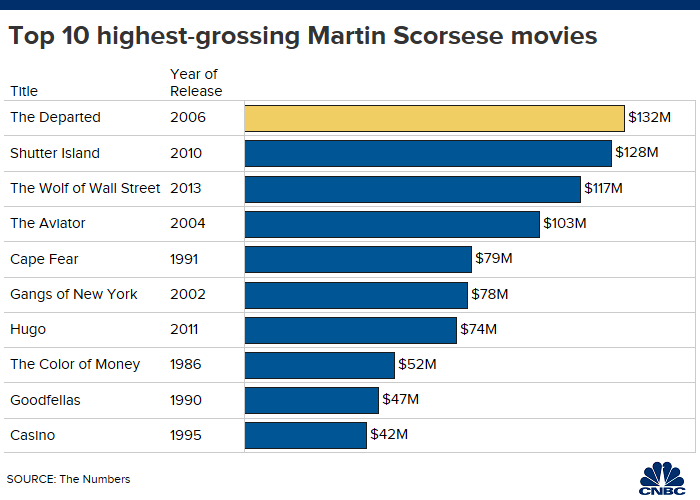

He pointed to Scorsese’s “The Departed,” which made $132 million domestically and $157 million in international markets, as an example of the kind of money that could be made in the U.S. and globally if Netflix were to make a deal with mainstream theaters to showcase the film in more locations and for a longer period of time.

Stone’s theater will be one of the few theaters in Kansas City playing “The Irishman.”

“Netflix would get 55% of the box office,” Stone said of the split with theaters. “Why not figure out a way to do this?”

Netflix declined to comment.

For Netflix, the goal is to drive more subscribers to sign up for its streaming service and to entice its current subscribers to stick with the service for another month or another year. If the company leaves a film in theaters for three months, the typical release window for major movie theaters, that’s three months it isn’t on the streaming service. Something that paying subscribers could balk at.

However, having a wide range of content, signing deals with other studios to house movies and TV shows and creating its own content cost Netflix more than $12 billion last year. This year, it’s expected to cost the company $15 billion. Since mid-2014, Netflix has been cash-flow negative, which means more money is flowing out of its business than it is taking in. Netflix has refused to alter its strategy to incorporate other monetary streams such as in-app advertising, a merchandising arm or extending the theatrical releases of its films.

Shares of Netflix, which have a market value of $127 billion, are down 11% in the last 12 months.